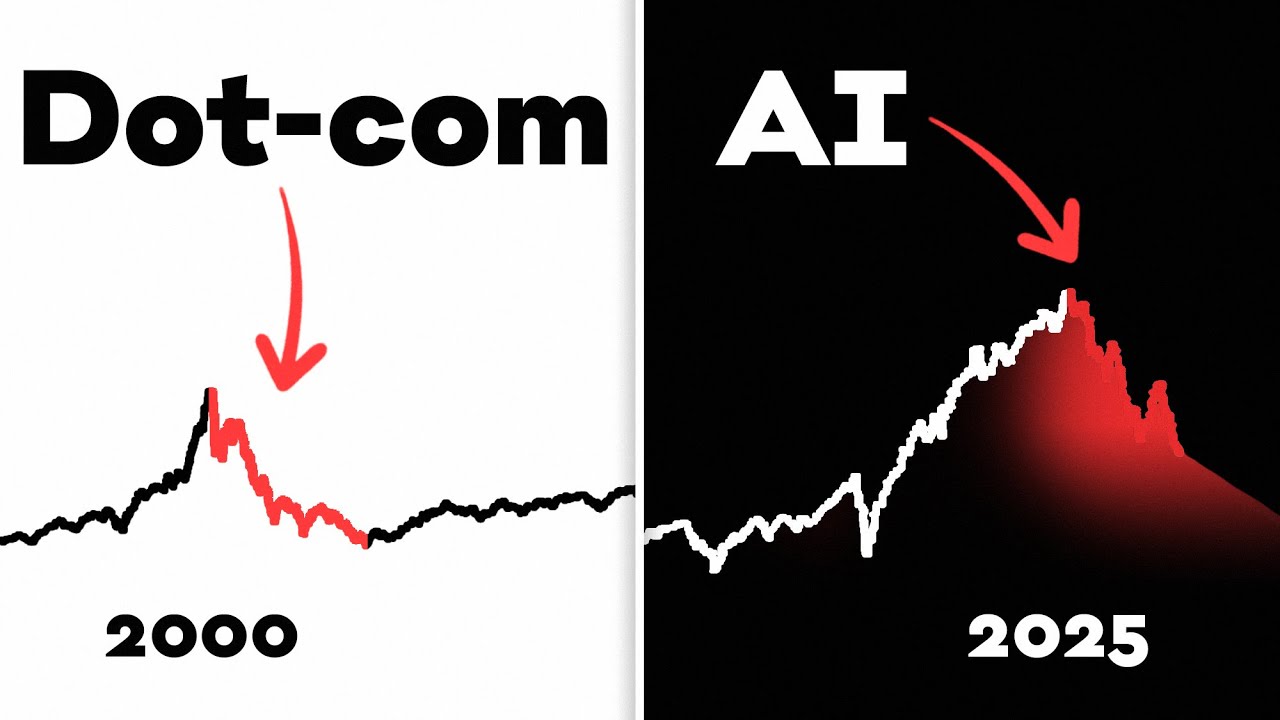

Why today’s AI euphoria echoes the 1990s internet bubble — and what makes it fundamentally different.

From Hype to Hard Value

Every economic transformation starts with a story. In 1999, it was “the internet will change everything.” In 2025, it’s “AI will change everything.” The resemblance is uncanny — frothy valuations, a gold rush of startups, and institutional capital piling in.

But here’s the crucial difference: AI is not building on speculation; it’s building on infrastructure.

The dot-com era was about laying digital rails — fiber optics, data centers, and browsers. Today’s AI era runs on those very rails. The infrastructure is already in place, and the marginal cost of intelligence is collapsing. That’s why this boom is less about exuberance and more about exponential productivity.

Three Structural Shifts That Make This Boom Real

1. The Economics of Intelligence

In the 1990s, internet companies monetized attention. In the 2020s, AI companies monetize cognition. That’s a seismic leap.

Every enterprise — from logistics to legal services — is discovering that machine reasoning is becoming a utility, much like electricity or cloud storage. The more models improve, the more they commoditize “thinking tasks” that once defined white-collar work.

This isn’t hype. It’s an economic shift toward intelligence as infrastructure.

2. Capital and Compute Are the New Oil and Steel

During the dot-com boom, venture money chased eyeballs. Today, it’s chasing GPUs and model weights. Nvidia’s trillion-dollar ascent is a signal: the new industrial base isn’t factories — it’s data centers.

The supply chain of the AI economy — chips, power, algorithms, and data — looks more like the energy industry than the software sector. It’s capital-intensive, geopolitically charged, and deeply physical.

That’s why governments — from the U.S. to the UAE — are investing in AI infrastructure as a strategic national asset, not just a commercial trend.

3. Real Products, Real Productivity

Dot-com startups promised disruption but often delivered vaporware. AI startups are already reshaping workflows and margins. From generative design in architecture to automated code in fintech, the productivity lift is visible and quantifiable.

According to McKinsey, AI could add $15 trillion to global GDP by 2030 — equivalent to adding an economy the size of China. Even if that estimate is optimistic, the direction of impact is clear: this is a real economy shift, not a speculative cycle.

The Hype Remains — But It’s Different This Time

Of course, hype is still part of the story. Startups are overpromising, investors are overspending, and AI “snake oil” is everywhere. But unlike 2000, the market corrections ahead won’t destroy the ecosystem — they’ll refine it.

Think of this as creative destruction for the cognition economy: weak business models will vanish, but the underlying technological infrastructure will remain and strengthen.

Looking Ahead

If the 1990s built the digital economy, the 2020s are building the cognitive economy.

The dot-com era connected people; the AI era connects intelligence.

And just as the internet quietly rewired every industry after the bubble burst, AI will do the same — only faster, deeper, and more pervasively.

The real opportunity isn’t in chasing the hype, but in understanding where intelligence compounds value — in data, in decision-making, and in design. That’s where tomorrow’s winners will emerge.

Follow Tomorrowist for more insights on innovation, deep tech, and value creation.